Table of Contents

In recent years, the United States has seen its trade deficit grow significantly, and President Donald Trump made reducing this imbalance a top priority during his presidency. His administration argued that renegotiating trade deals, implementing protectionist policies, and confronting major trading partners—especially China—would help shrink the trade deficit, create jobs, and strengthen national security. But the question remains: How much does the U.S. trade deficit really matter, and what can be done to address it?

What is a Trade Deficit?

A trade deficit occurs when a country imports more goods and services than it exports. For the U.S., this means that more money is flowing out of the country to pay for foreign-made goods than is coming in from the sale of U.S. exports. In 2024, the United States had a trade deficit of over $900 billion, with goods accounting for $1.2 trillion of this imbalance. The U.S. exports a wide variety of goods and services, including aircraft, refined petroleum, and financial services, while its imports are dominated by electronics, consumer goods, and crude oil.

It’s important to differentiate between a country’s overall trade deficit and its bilateral trade deficits. While the U.S. has a substantial overall trade deficit, it also has imbalances in trade with individual countries. For example, the U.S. has a large deficit with China, but it also has surpluses with other countries in services trade. So, reducing the trade deficit with one country does not necessarily result in an overall reduction of the U.S. trade deficit.

What Causes the U.S. Trade Deficit?

At the root of the U.S. trade deficit is an imbalance between the country’s savings and investment. When Americans spend more money than they save, this extra spending flows toward foreign goods and services, leading to a trade deficit. Financing this excess spending often involves borrowing from foreign lenders or attracting foreign investment in U.S. assets.

Several macroeconomic factors contribute to the U.S. trade deficit, including:

- Government Spending: More government spending can reduce the national savings rate, contributing to a higher trade deficit.

- Stronger Dollar: A stronger U.S. dollar makes foreign goods cheaper for American consumers but makes U.S. exports more expensive for foreign buyers, which can increase the trade deficit.

- Economic Growth: As the U.S. economy grows, consumers tend to buy more goods from abroad, which also increases imports.

Economists generally argue that these factors are more important than trade policy in determining the overall trade deficit. While trade deals and tariffs might shift trade deficits between countries, they do not significantly change the overall deficit.

The History of the U.S. Trade Deficit

The U.S. trade deficit has been growing for decades. In the 1960s and 1970s, the U.S. generally had either a small deficit or a surplus. However, since the 1980s, the deficit has steadily expanded, reaching a peak of more than $944 billion in 2022. The trade deficit has averaged around $594 billion since 2000, and it currently represents about 3.1 percent of the U.S. GDP.

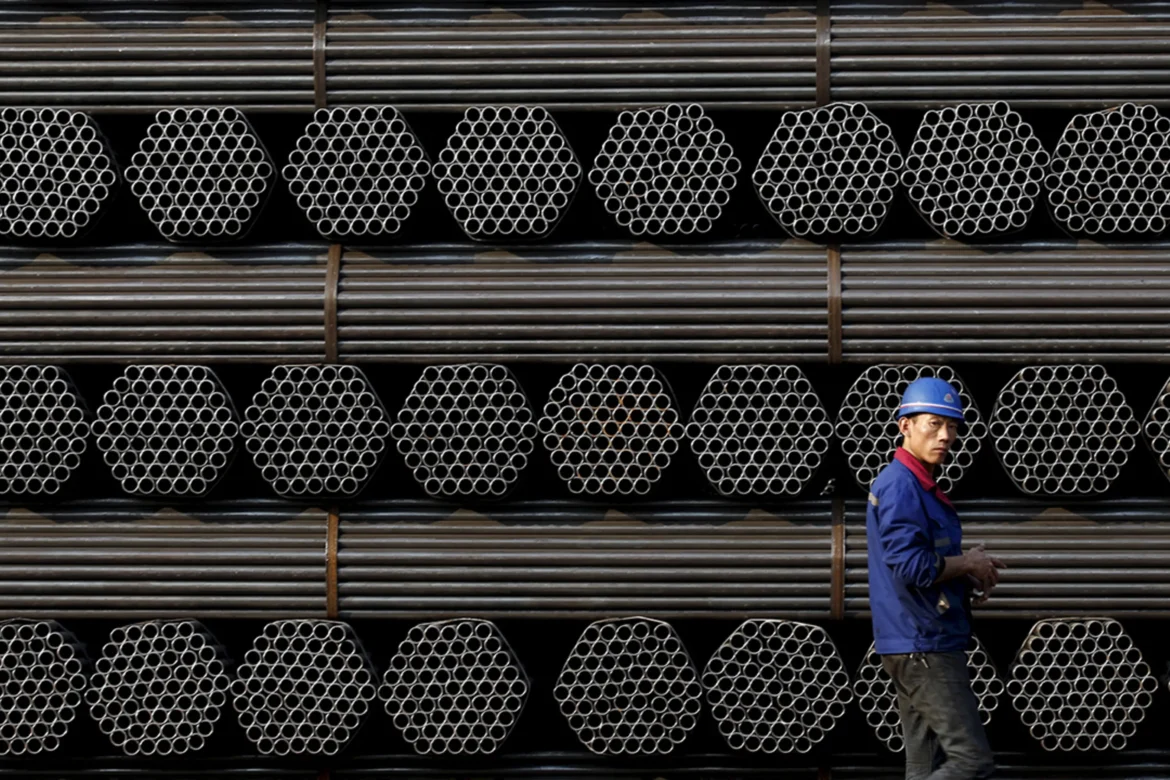

One of the largest contributors to this growing deficit is trade with China. The U.S. ran a $295 billion goods deficit with China in 2024, partially offset by a U.S. services surplus with China of $32 billion. This deficit has grown significantly since China’s economic reforms in the late 1990s and its entry into the World Trade Organization (WTO) in 2001, leading to an increased flow of Chinese exports to the U.S.

China’s rapid industrialization and government subsidies to production have helped drive this imbalance, which some economists refer to as the “China Shock.” This trend continues, with China maintaining a significant presence in global manufacturing and driving exports to the U.S. In fact, the global demand for goods during the COVID-19 pandemic and China’s increased competitiveness in sectors like clean energy and semiconductors have led to what’s being called the “Second China Shock.”

Why Are Policymakers Concerned About the Trade Deficit?

President Trump and his economic advisors have been vocal in expressing concerns about the U.S. trade deficit, arguing that it poses a threat to both economic and national security. The main fear is that the U.S. relies heavily on foreign debt and investment to finance its trade deficit. Trump has argued that the trade deficit harms the U.S. manufacturing sector, hollowing out jobs and threatening critical industries. Furthermore, the reliance on foreign financing could make the U.S. vulnerable to economic pressures from adversaries.

Some policymakers also argue that countries like China use unfair trade practices—such as currency manipulation, subsidies, and wage suppression—to boost exports, while blocking U.S. imports. This is seen as a major factor contributing to the trade imbalance, particularly in the manufacturing sector, where many U.S. jobs have been lost. Research by the Economic Policy Institute suggests that between 2001 and 2018, the rise in Chinese imports led to the loss of 3.7 million jobs in the U.S.

Arguments Against Focusing on the Deficit

Many economists, however, argue that the overall trade deficit is not as problematic as it’s made out to be. They point out that a trade deficit can actually be a sign of a healthy, growing economy. As consumers earn more money, they tend to buy more goods from abroad, increasing imports. Moreover, the U.S. has a massive services surplus, which helps offset its goods deficit. For example, the U.S. exports a significant amount of financial services, intellectual property, and other services that bring money into the economy.

Economist Inu Manak of CFR challenges the Trump administration’s narrow focus on goods deficits, emphasizing that the U.S. economy benefits from foreign goods and investments, even as the country runs a trade deficit. Furthermore, the U.S. role as the world’s largest consumer and the dollar’s status as the global reserve currency allows the U.S. to finance its deficit at a low cost, boosting demand globally and contributing to economic stability.

Policy Options for Reducing the Trade Deficit

Several policy approaches have been proposed to reduce the U.S. trade deficit:

- Imposing Tariffs: President Trump’s approach involved imposing tariffs on foreign goods to make imports more expensive and encourage domestic production. However, some economists argue that tariffs can reduce both imports and exports, slow productivity growth, and hurt consumers.

- Reducing the Fiscal Deficit: Another approach is to reduce the U.S. government’s budget deficit. By cutting government spending and lowering the national debt, the U.S. could boost its savings rate, which could help reduce the trade deficit.

- Boosting U.S. Exports: Increasing U.S. exports could be a more effective way to reduce the deficit. Instead of focusing on limiting imports through tariffs, boosting exports through better access to foreign markets could help create jobs and stimulate innovation.

- Amending U.S. Tax Law: Some economists suggest amending the U.S. tax code to reduce the incentives for foreign investment in U.S. assets, which would in turn reduce the trade deficit.

- Reforming Surplus Countries: Pressuring countries with trade surpluses, such as China, to raise their domestic consumption could help reduce the overall trade deficit. This could be done through diplomatic efforts and international agreements.

- Cutting Domestic Spending: Reducing U.S. domestic spending could help lower the trade deficit by boosting the national savings rate. However, many question whether this is a feasible solution, given that much of the federal budget is allocated to defense, entitlements, and interest on the national debt.

Conclusion

The debate over the U.S. trade deficit is complex and ongoing. While President Trump and many of his advisors view the deficit as a serious economic and national security threat, many economists argue that the deficit is not inherently harmful and that trade deficits can coexist with a strong economy. The real challenge is to ensure that trade policies foster growth and job creation without triggering a global trade war or harming the U.S. economy in the long run. As the U.S. continues to navigate its trade relationships, the focus should be on striking a balance that promotes economic stability and growth for all parties involved.

Author Profile

- Syed Tahir Abbas is a Master's student at Southwest University, Chongqing, specializing in international relations and sustainable development. His research focuses on U.S.-China diplomacy, global geopolitics, and the role of education in shaping international policies. Syed has contributed to academic discussions on political dynamics, economic growth, and sustainable energy, aiming to offer fresh insights into global affairs.

Latest entries

U.S. Foreign PolicyFebruary 2, 2026AI and Grand Strategy: The Case for Restraint – Navigating the Future of American Power

U.S. Foreign PolicyFebruary 2, 2026AI and Grand Strategy: The Case for Restraint – Navigating the Future of American Power National SecurityJanuary 31, 2026Treating China’s Connected Energy Systems as a National Security Risk

National SecurityJanuary 31, 2026Treating China’s Connected Energy Systems as a National Security Risk Global HealthJanuary 29, 2026The Future of the WHO—and How the United States Can Shape It

Global HealthJanuary 29, 2026The Future of the WHO—and How the United States Can Shape It Global TradeJanuary 22, 2026Trump Cancels Tariffs on European Nations Over Greenland Pursuit?

Global TradeJanuary 22, 2026Trump Cancels Tariffs on European Nations Over Greenland Pursuit?

3 comments

Keep up the superb work, I read few content on this website and I think that your weblog is really interesting and has sets of great info .

excellent post.Never knew this, thanks for letting me know.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.